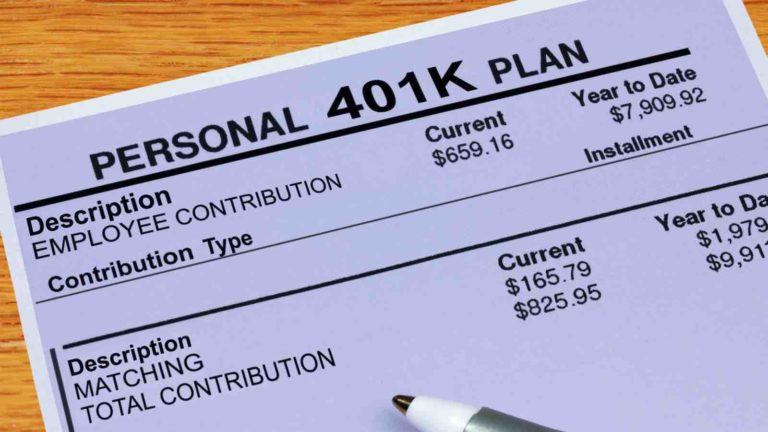

What Happens If I Stop Adding To My 401(k)?

Posted: December 28, 2019

If you have a 401(k) account through your employer, it is never a good idea to stop contributing to it, even temporarily, if you can possibly avoid it. If you are experiencing a financial crisis of some sort, the solution is not to stop adding to your 401(k). The following are some important reasons to continue contributing to your 401(k), even in times of financial...

Three Uncommon Life Insurance Scenarios

Posted: December 22, 2019

In most cases, when the insured on a life insurance policy dies, the proceeds are paid out to named beneficiaries without a hitch. However, you should be aware of certain unusual scenarios that could occur. Speak with our knowledgeable agent for professional help in avoiding potentially tricky situations with your life insurance policy. Beneficiaries & Insured Persons Die At The Same Time It is not...

Understanding Kidnap & Ransom Insurance

Posted: December 19, 2019

Kidnapping for ransom is a lucrative business for perpetrators and more prevalent than you may think. The Insurance Information Institute (III) reports that kidnapping for ransom is on the increase. Prime targets are wealthy businesspeople and their families, professionals traveling abroad, journalists, and aid workers. Most kidnappings of Americans for ransom or extortion occur in Mexico, Columbia, Central or South American countries, parts of Africa,...

Will My Homeowners Insurance Cover Damage To My Yard?

Posted: December 16, 2019

Each homeowners insurance policy is different. Our friendly agent will be happy to review your policy with you to help ensure you have the coverage you need. Generally, homeowners insurance covers a broad range of potential damages that includes the dwelling itself and other structures on the property, such as a fence, shed, or driveway. The following can give you an idea of what is...

Should I Sign Up For Life Insurance Through Work If I Already Have A Life Insurance Policy?

Posted: December 13, 2019

Life insurance is offered by some employers as part of their group benefits package. Usually, the employer pays for most or all of the premiums. Companies are not required to provide life insurance for their employees. When they do, it is a nice benefit, and you should take advantage of it. If you already have an individual life insurance policy, that is ideal, as group...